Introduction & methodology

SMOOTH SAILING?

Turnover's up for many travel management companies and technology is transforming operations, but geopolitics and policy shifts could yet rock the boat

By Mark Frary (published 23 June 2025)

Introduction & methodology

SMOOTH SAILING?

Turnover's up and technology is transforming operations, but geopolitics and policy shifts could yet rock the boat

By Mark Frary (published 23 June 2025)

Business travel is changing. It always does.

For the past two years, corporate travel managers have had to face fast-rising business travel costs as inflation soared and airlines, hotels and other travel suppliers flexed their muscles after the lean years of the pandemic in order to restore their balance sheets.

The extensive research carried out for Business Travel News Europe*s Leading Travel Management Companies 2025 shows that turnover in the sector is booming and TMCs are doing better, becoming more efficient and have their eyes firmly fixed on the future.

Yet the geopolitical backdrop to the world of business travel is uncertain, thanks to the return of President Donald Trump and his America First policies that threaten a global trade war built on high tariffs and conflicts in the Middle East, Russia-Ukraine and beyond. Business travel is built on globalisation, and anything that restricts trade or makes economies shrink is going to be unwelcome.

TMCs are getting leaner. They are embracing technologies such as artificial intelligence to make their operations slicker. All say that they are not intending to remove the human touch from the corporate-TMC relationship but instead allow them to deliver a better customer experience. Corporates who dealt with travel management companies through Covid will say that this comes not a moment too soon.

Despite Trump*s attack on DEI policies and his renewed love of fossil fuels, Europe*s TMCs are embracing both diversity and sustainability as this report shows. Whether this enthusiasm continues into 2025 will be worth watching.

REPORT METHODOLOGY

The annual Europe's Leading TMCs report is compiled from information supplied from travel management companies during the period from March to June each year. The information is gathered through a comprehensive questionnaire that we review each year for its relevance. This year we moved to a new data management platform in order to be able to slice and dice the information in more ways than ever before.

We would like to thank all of those TMCs who have completed the questionnaire and answered follow-up questions. The very patient but busy senior executives who have completed the questionnaire will know that we ask for comprehensive information on their activities, from DEI and ESG policies to whether they prefer to develop their technology in-house or work with third-party providers.

We have also asked our TMCs for more information on which technology providers they work with. We hope this will help give an even clearer indication of who is doing what in a world where technology is an important differentiator.

Once again, the leading TMC rankings cover seven key markets in Europe: Benelux, France, Germany, Italy, the Nordics, Spain and the UK. We have also analysed those entries to create a ranking of the top 50 travel management companies across the whole of Europe.

Europe's Leading TMCs has grown substantially since it first appeared in 1997, when it only covered the UK. This year the ranking is more comprehensive than ever, covering more TMCs in more countries. We know that it is a hugely popular resource for travel managers and others in the business travel sector throughout the UK and Europe.

As always, the ranking comes with a caveat. Despite sometimes less than gentle encouragement and downright pig-headedness, some TMCs are unwilling to supply us answers to every question for this ranking, including the key financial statistics that we use to rank TMCs. A few years ago we took the decision to include all of the major TMCs in this ranking, regardless of whether they supplied the necessary information. This means that for some travel management companies, we have to make estimates of certain key figures, notably the gross sales figure, rather like the compilers of the Sunday Times Rich List do. These are clearly marked.

We make these estimates as rigorous as possible. This involves looking at the company registers in all of the countries in the report, and scouring the trade and business press in countries across Europe to find statements by TMC executives about their organisation*s sales volumes. We also use historic ratios of revenue to gross sales to make estimates. It is also worth noting that to compare figures we have used average annual exchange rates between the key currencies. While it would be ideal to have everyone provide audited figures, we believe this is the best pragmatic answer.

We believe that the figures we use reflect the state of the market. However, we recognise that the ranking may not completely reflect the true state of the market. We therefore encourage all TMCs in the ranking, as well as those who are not included and who believe they should be, to share their details with us so they can be included in future editions. Please email Mark Frary at mfrary@thebtngroup.com.

ADVISORY BOARD

This year, we have again worked with an advisory board to help with the production of this Europe's Leading TMCs report, both to guide the direction of the ranking and to provide expert analysis of the findings. Business Travel News Europe would like to thank Alexandre Veau of Impact Consultants, Tom Drexler and Jens Vongehr of The Travel Consulting Group in Germany, Rosemarie Caglia of Travel for Business, Clive Wratten of The Business Travel Association, Julia Lo Bue-Said OBE of the Advantage Travel Partnership, and former general manager of the Swedish Business Travel Association and now of Areka Consulting Lotten Fowler for their input into this research.

SURVEY RESULTS

Below are the results of two surveys carried out by the BTN Group. The first section conveys how travel managers feel about travel management companies and was conducted by Business Travel Show Europe in March. The second section examines what TMCs think of their own prospects and challenges in the year ahead and was conducted by BTN Europe as part of this annual report. Scroll down to explore the results of both surveys.

WHAT BUYERS SAY ABOUT TMCs

A survey of nearly 100 European travel managers was conducted by Business Travel Show Europe in February to ascertain current views of travel management companies. Explore the findings below...

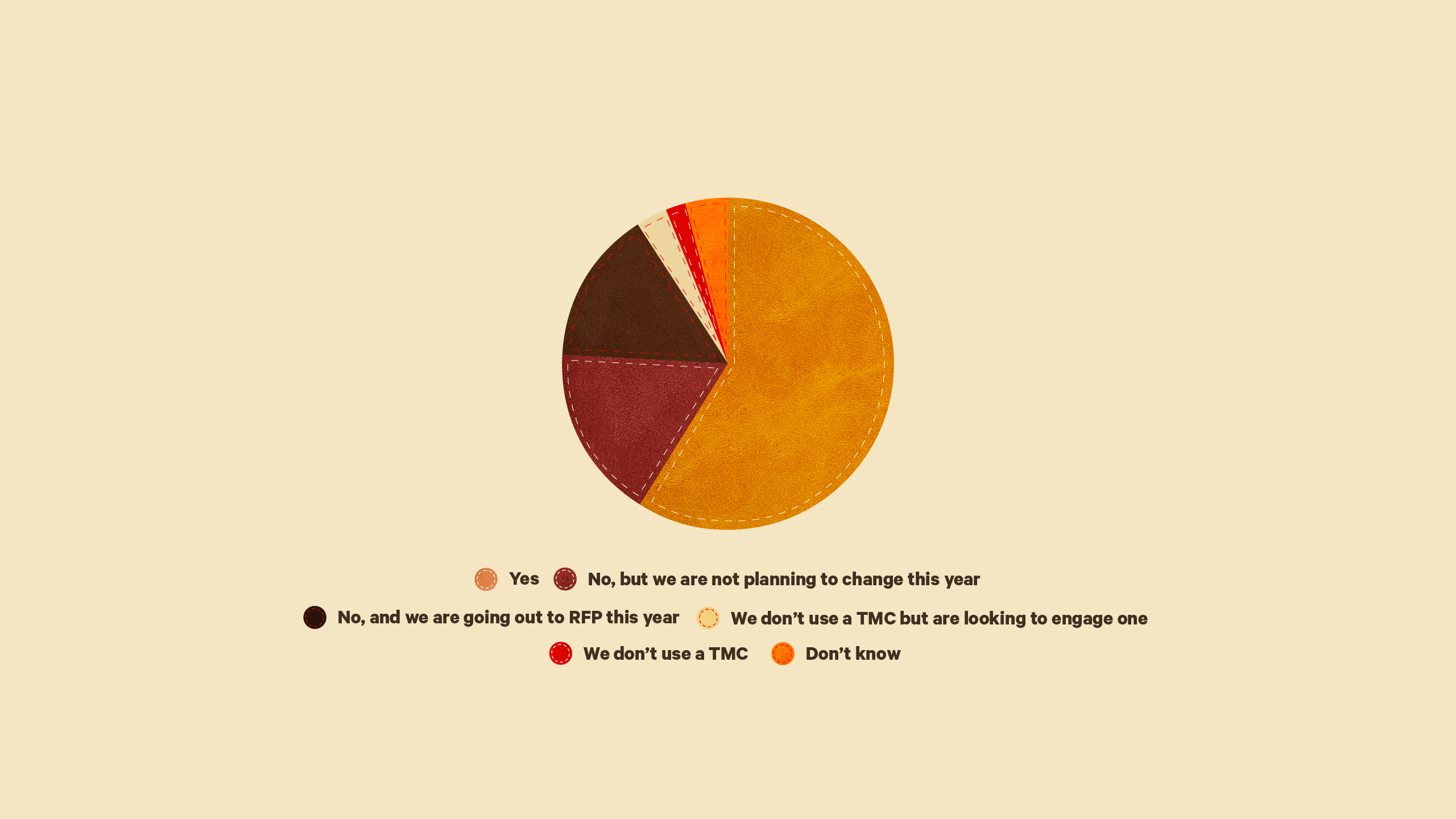

MOSTLY HAPPY

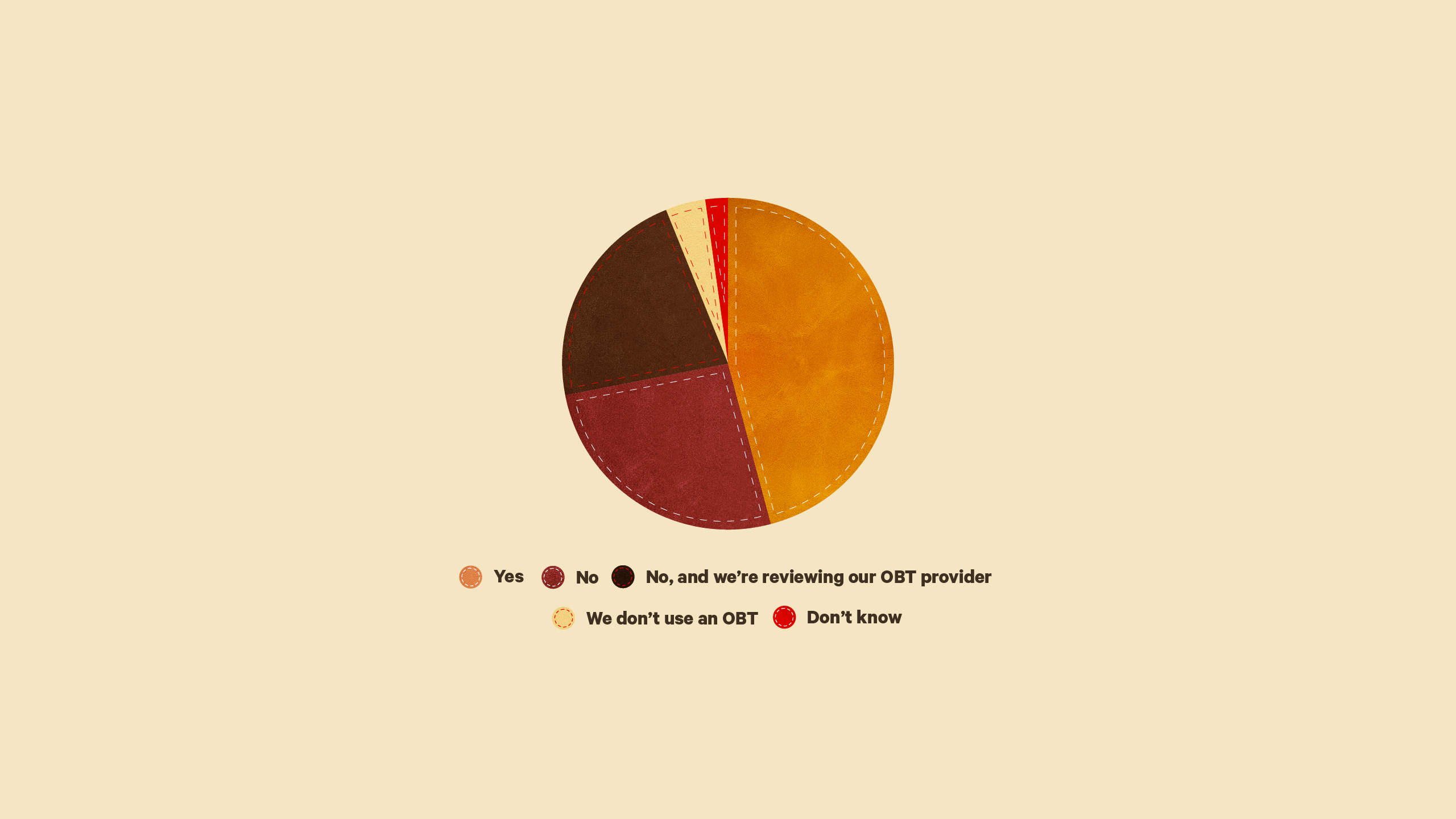

Are you happy with your travel management company?

Although more than half of respondents said they were happy with their primary TMC, nearly a third said they were not. Half of those respondents 每 and 15 per cent of the total 每 said they would be going out to RFP this year.

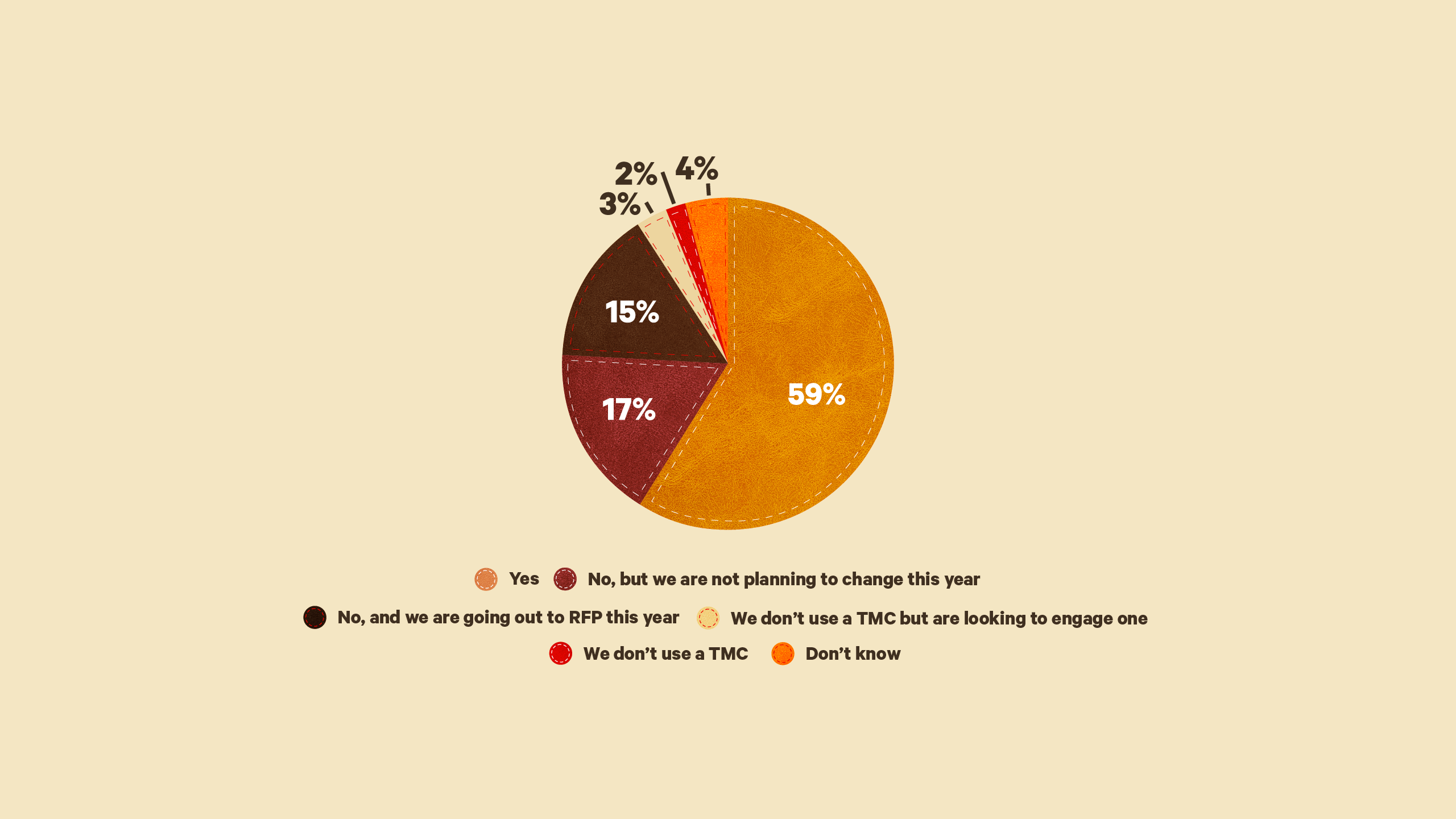

GETTING TOGETHER

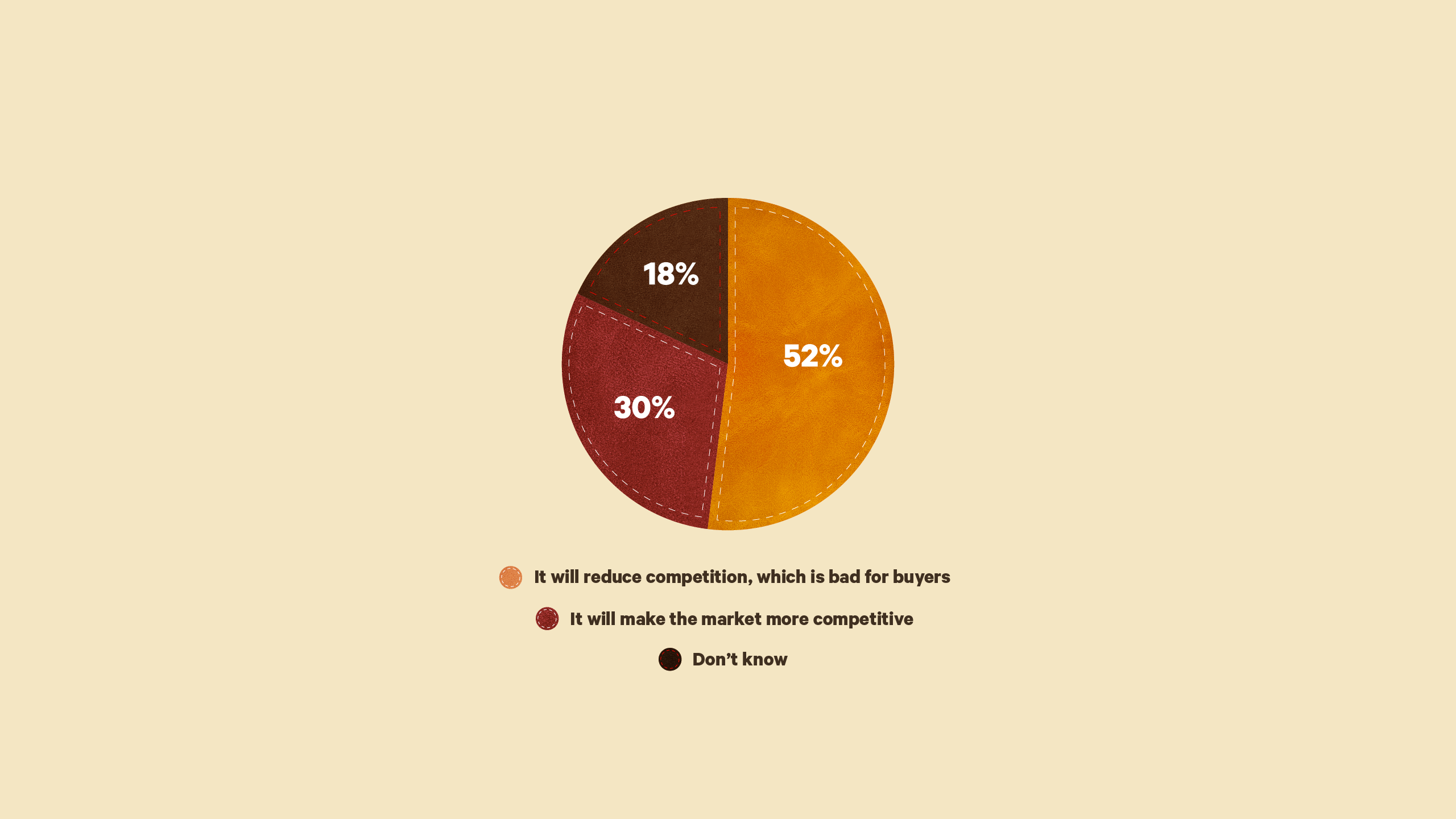

What do you think of TMC consolidation?

Slightly more than half of the travel managers surveyed believe that consolidation of the TMC market will reduce competition and be bad for buyers. Conversely, three in ten respondents believe further consolidation will make the market more competitive.

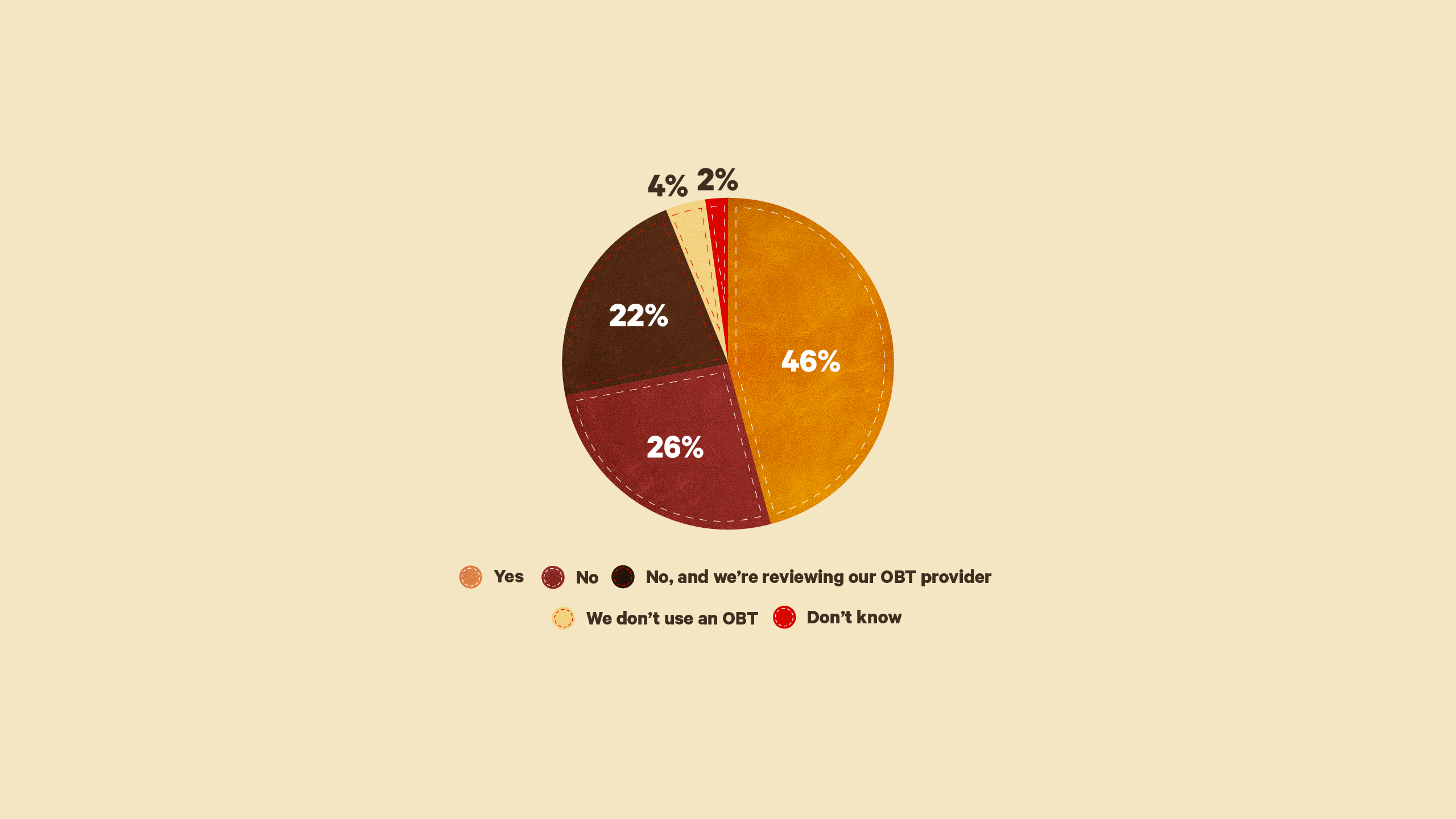

NOT CLICKING

Are you happy with your online booking tool?

Although not necessarily a direct reflection on TMCs themselves, less than half of travel buyers surveyed said they were happy with their primary online booking tool. A similar amount declared themselves unhappy with their OBT, with slightly less than half of those reviewing or planning to review their technology provider.

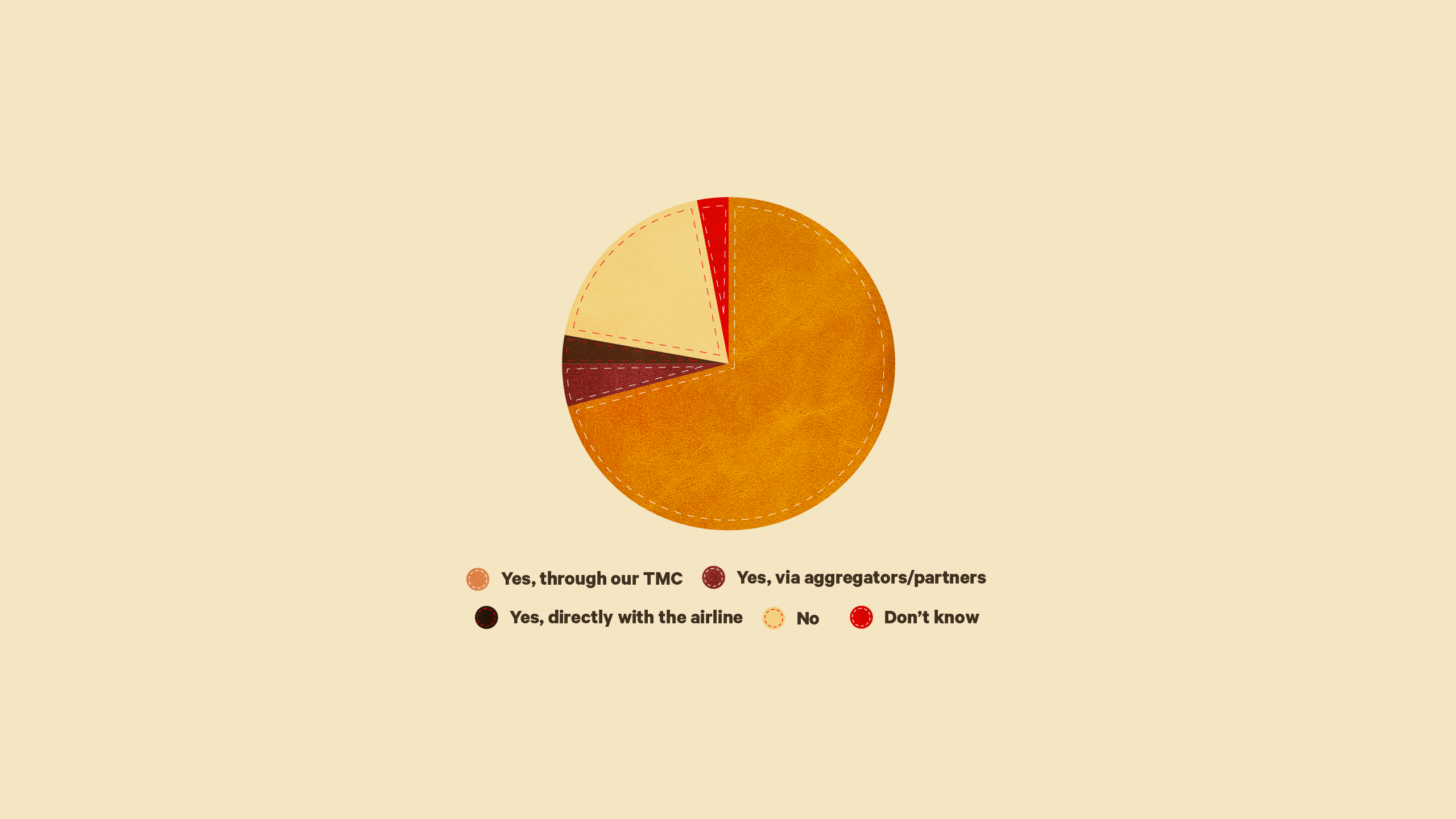

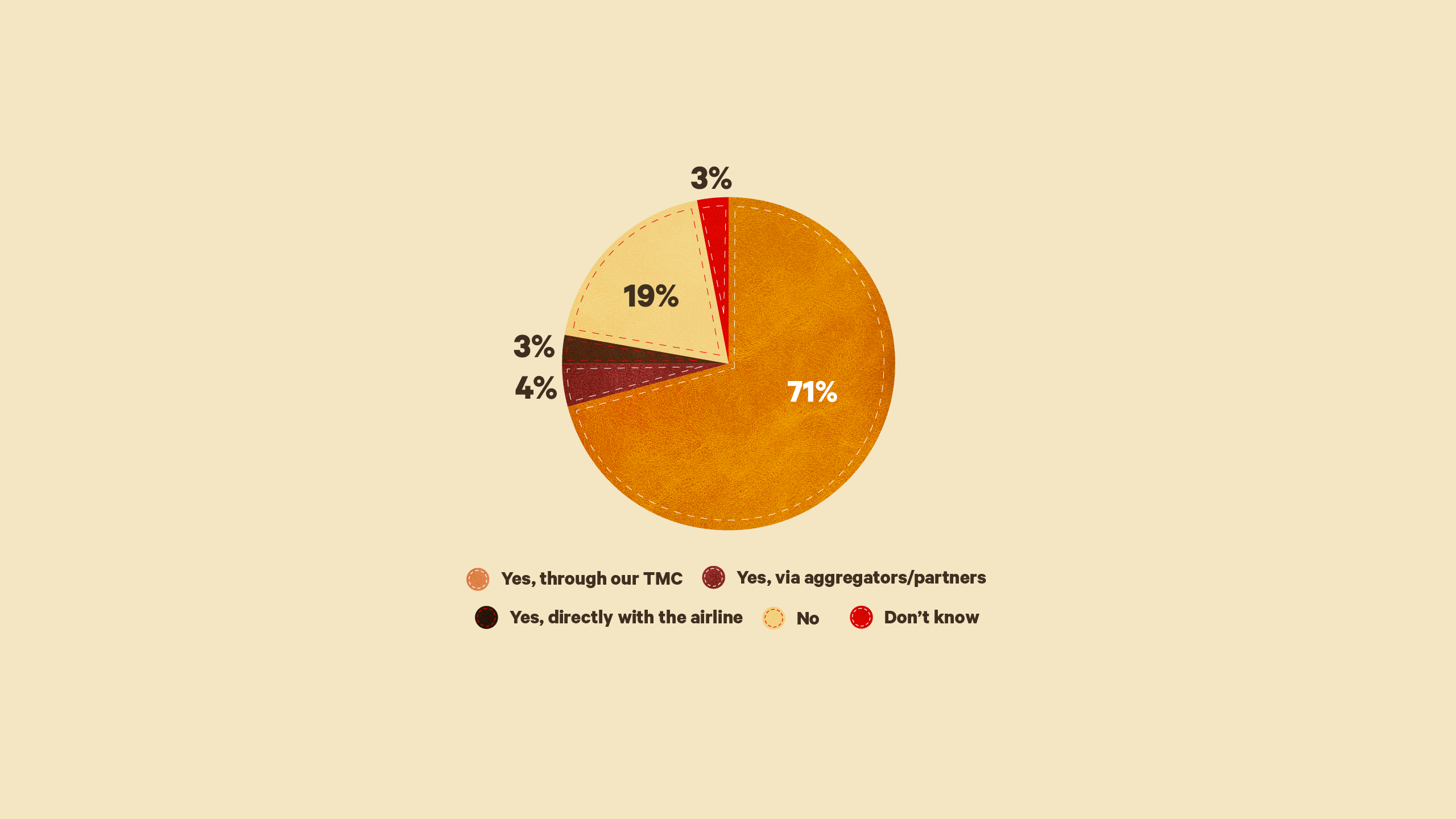

CONNECTED CONTENT

Are you currently accessing NDC content?

For those travel managers currently accessing NDC content 每 around three-quarters of those surveyed 每 the vast majority of them are doing so through their travel managment company. Only three per cent of respondents said they are booking NDC content directly with their airline partners.

WHAT TMCs SAY ABOUT THEIR PROSPECTS

As part of the research conducted in compiling Europe's Leading TMCs 2025, participating travel management companies were asked for their views on the potential for business growth and what might stand in the way of expansion. Explore the findings below...

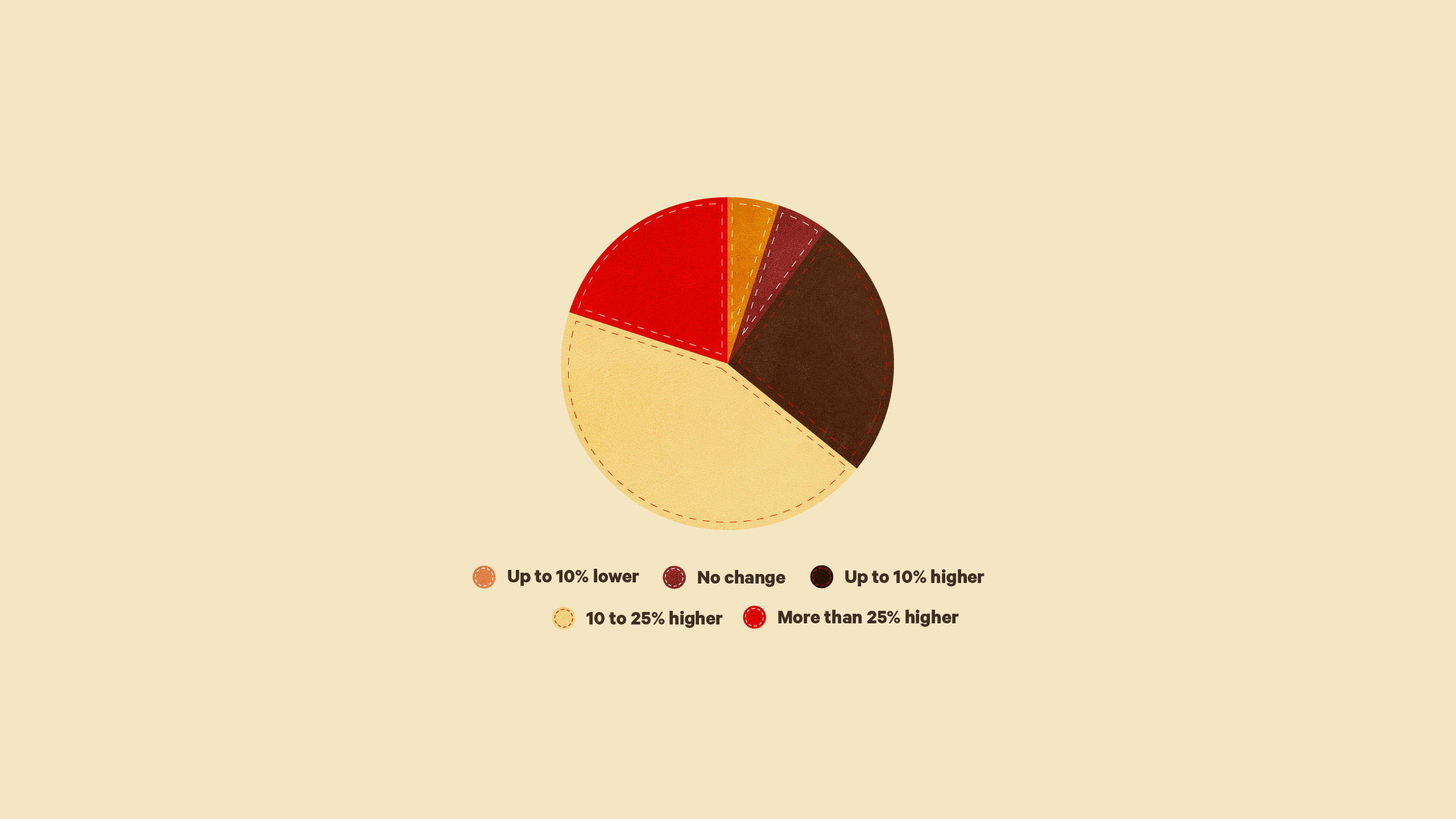

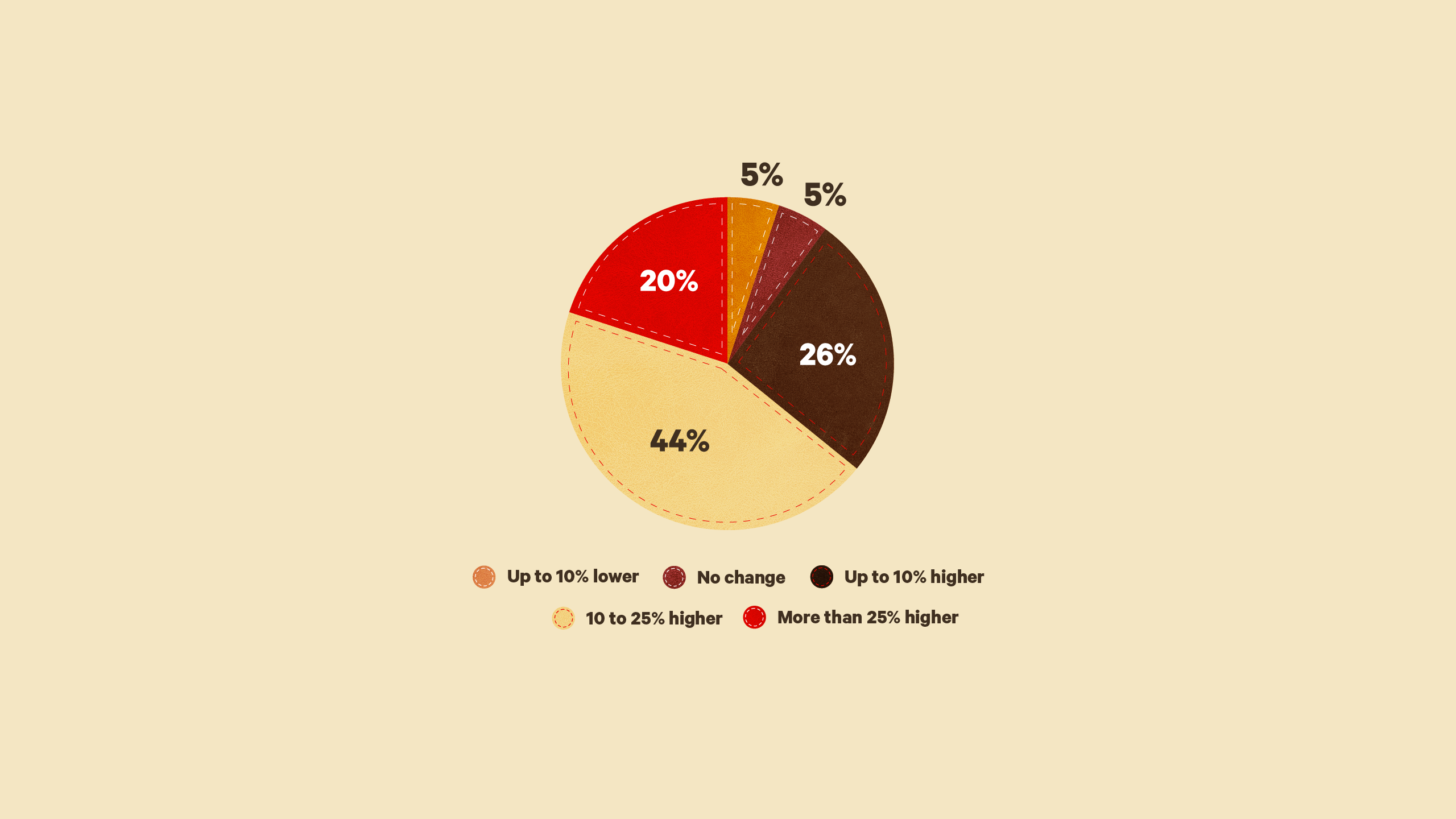

EXPANSION EXPECTED

How do you expect 2025 sales to compare to 2024?

A convincing 90 per cent of the travel management companies surveyed expect to achieve business growth in 2025, with around half of those predicting expansion in the region of 10% to 25%. One in five were even more optimistic, forecasting growth of more than 25%

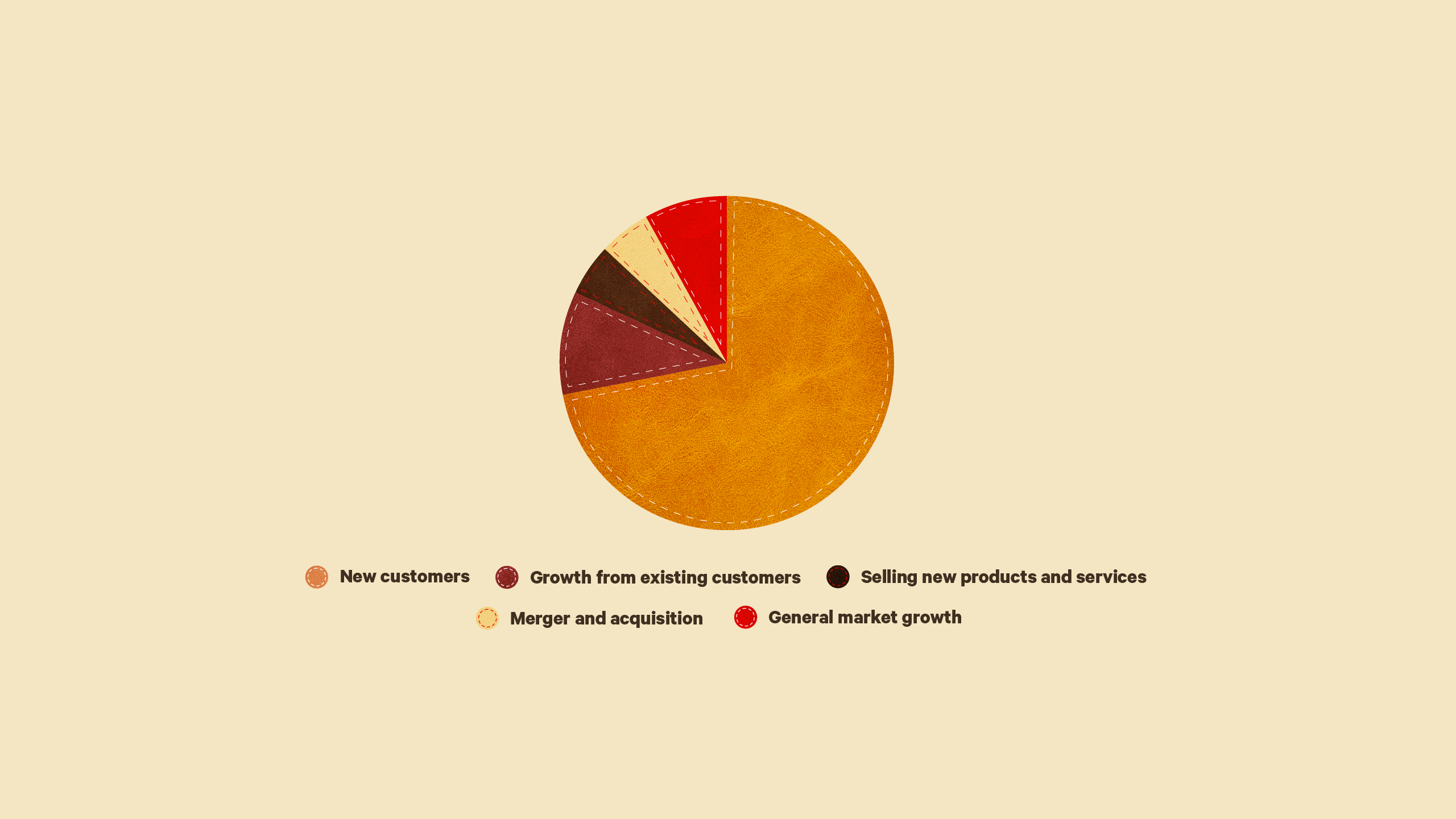

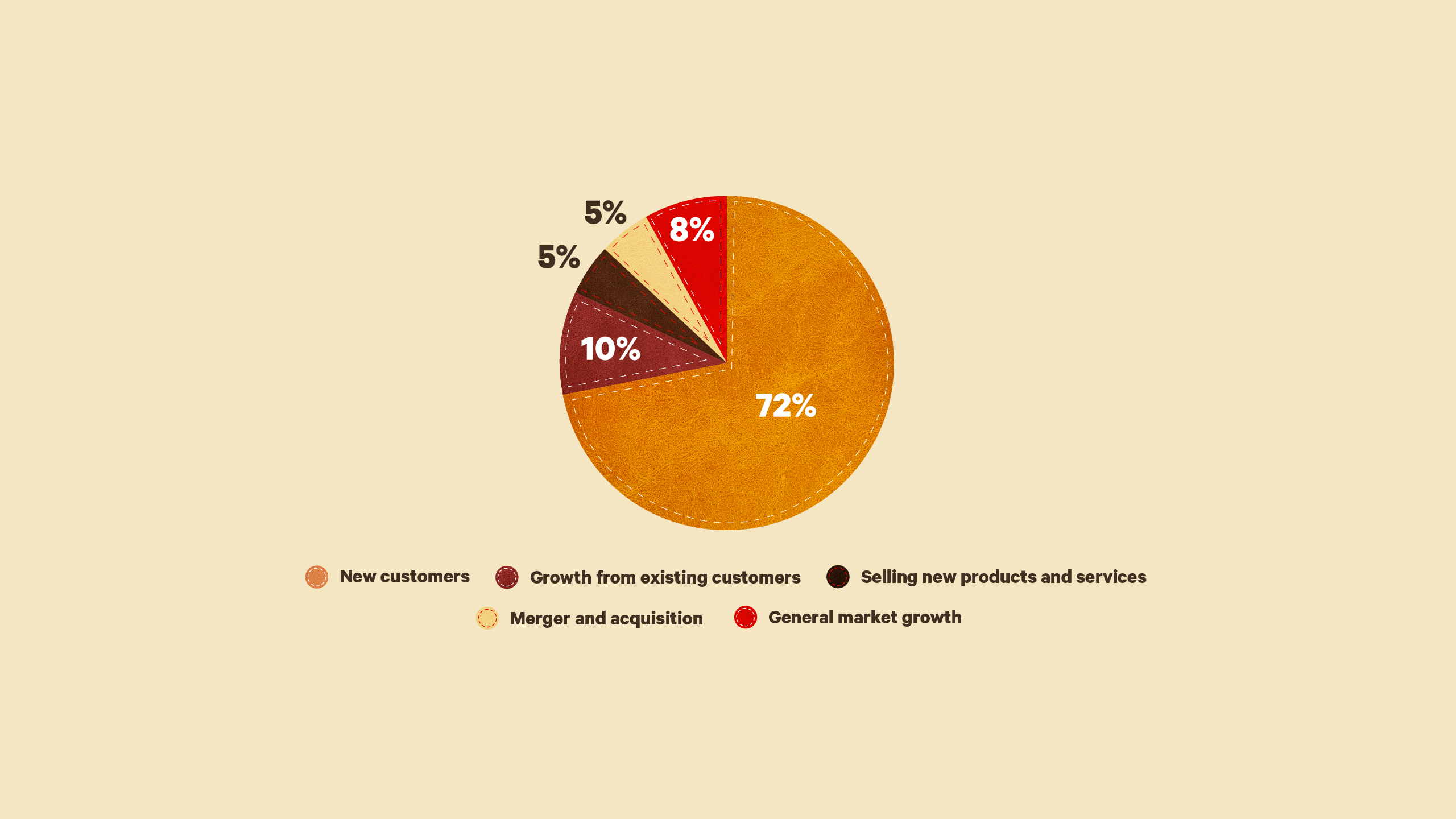

GROWTH DRIVERS

What will be your key growth driver in 2025?

Nearly three-quarters of travel management companies expect business growth in 2025 to be driven by new business wins, with ten per cent instead pointing to increased travel activity among existing clients. Five per cent of TMCs are poised to achieve growth by selling new products and services and a similar figure anticipate M&A activity.

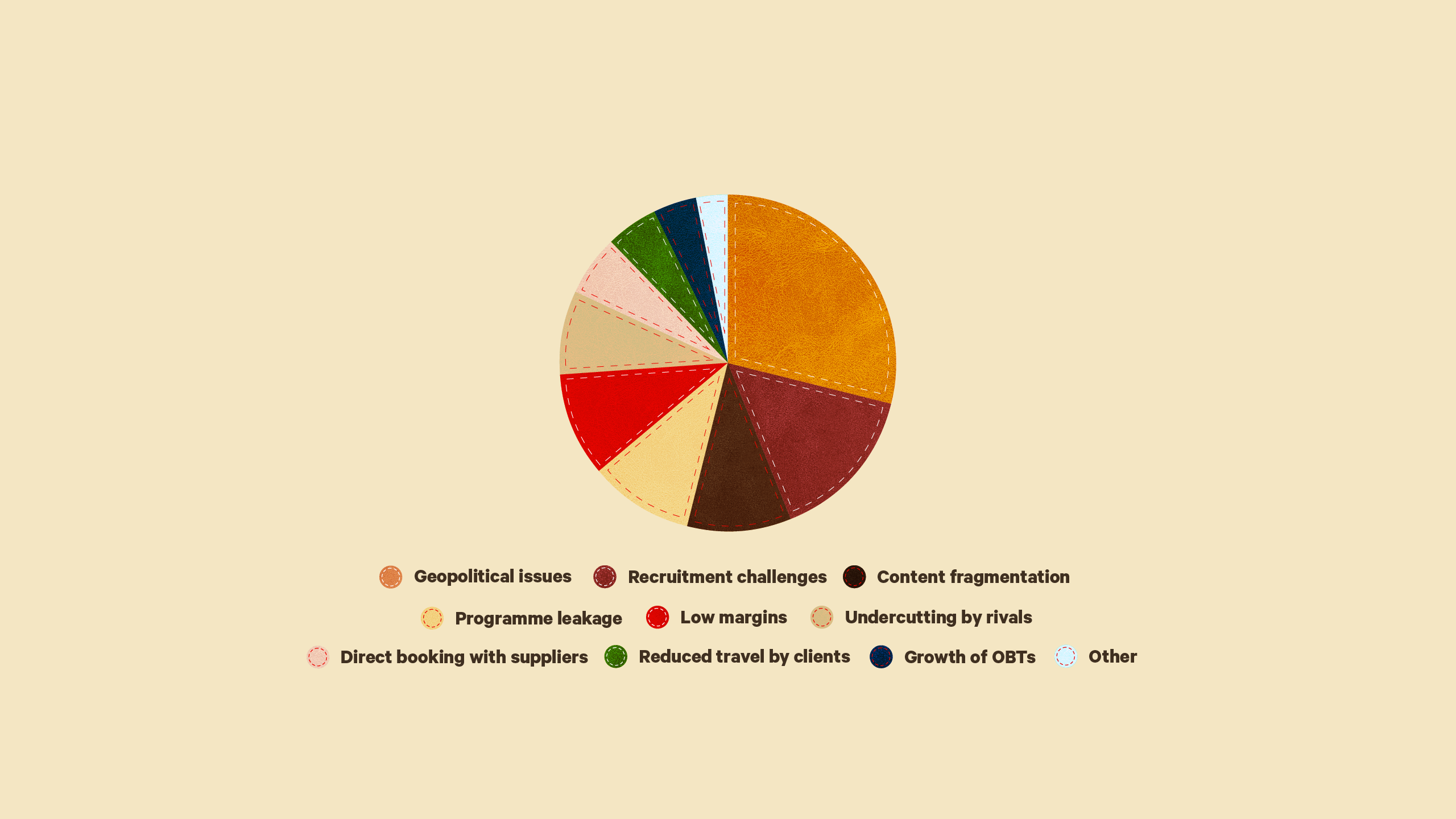

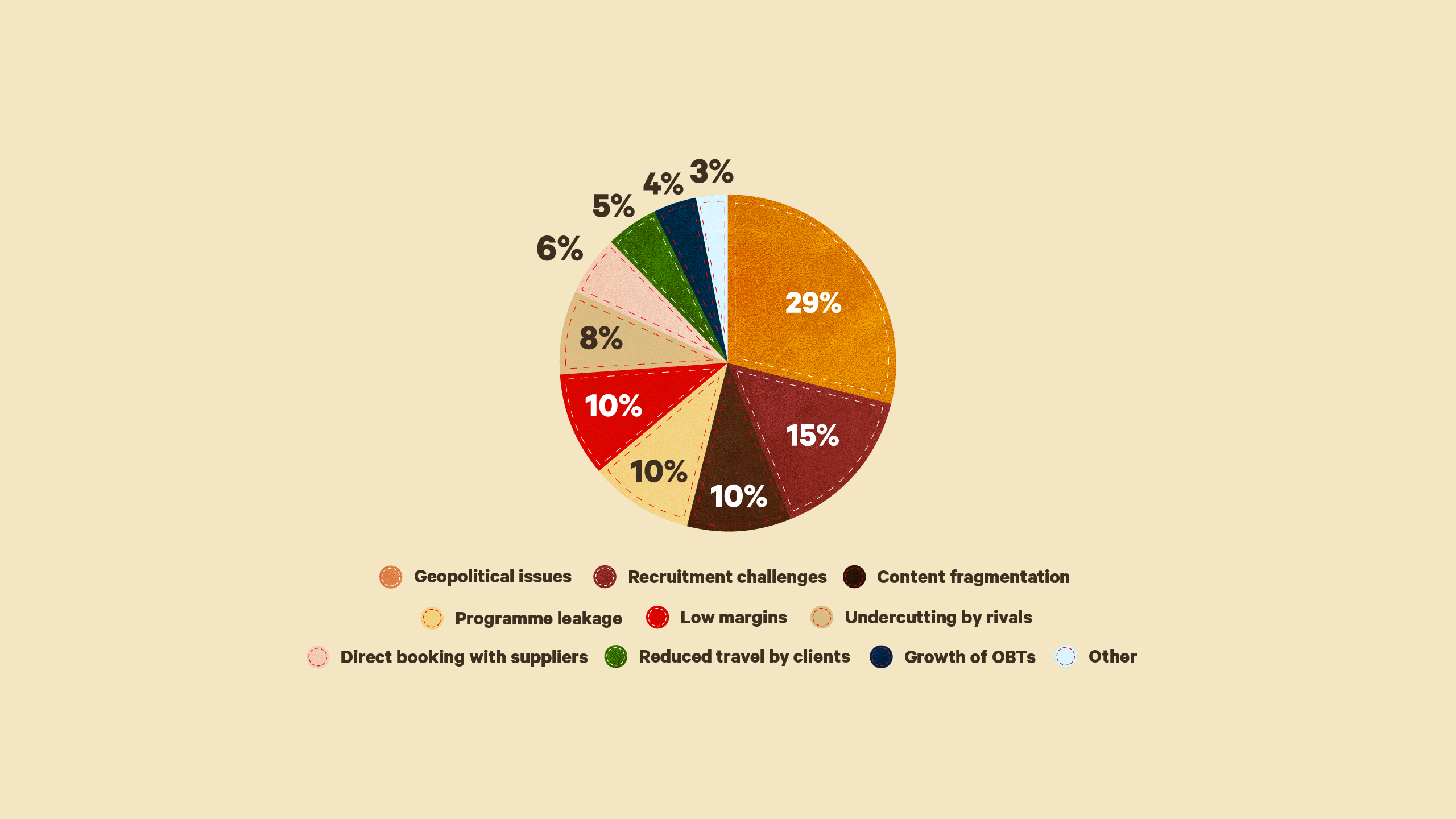

STANDING IN THE WAY

What is the biggest challenge to your success in 2025?

Perhaps it was no surprise that geopolitical issues emerged as the biggest challenge to business growth in 2025 每 cited by 29 per cent of TMCs 每 but recruitment issues still linger (15 per cent) and content fragmentation, programme leakage and low margins were each highlighted by ten per cent of respondents.

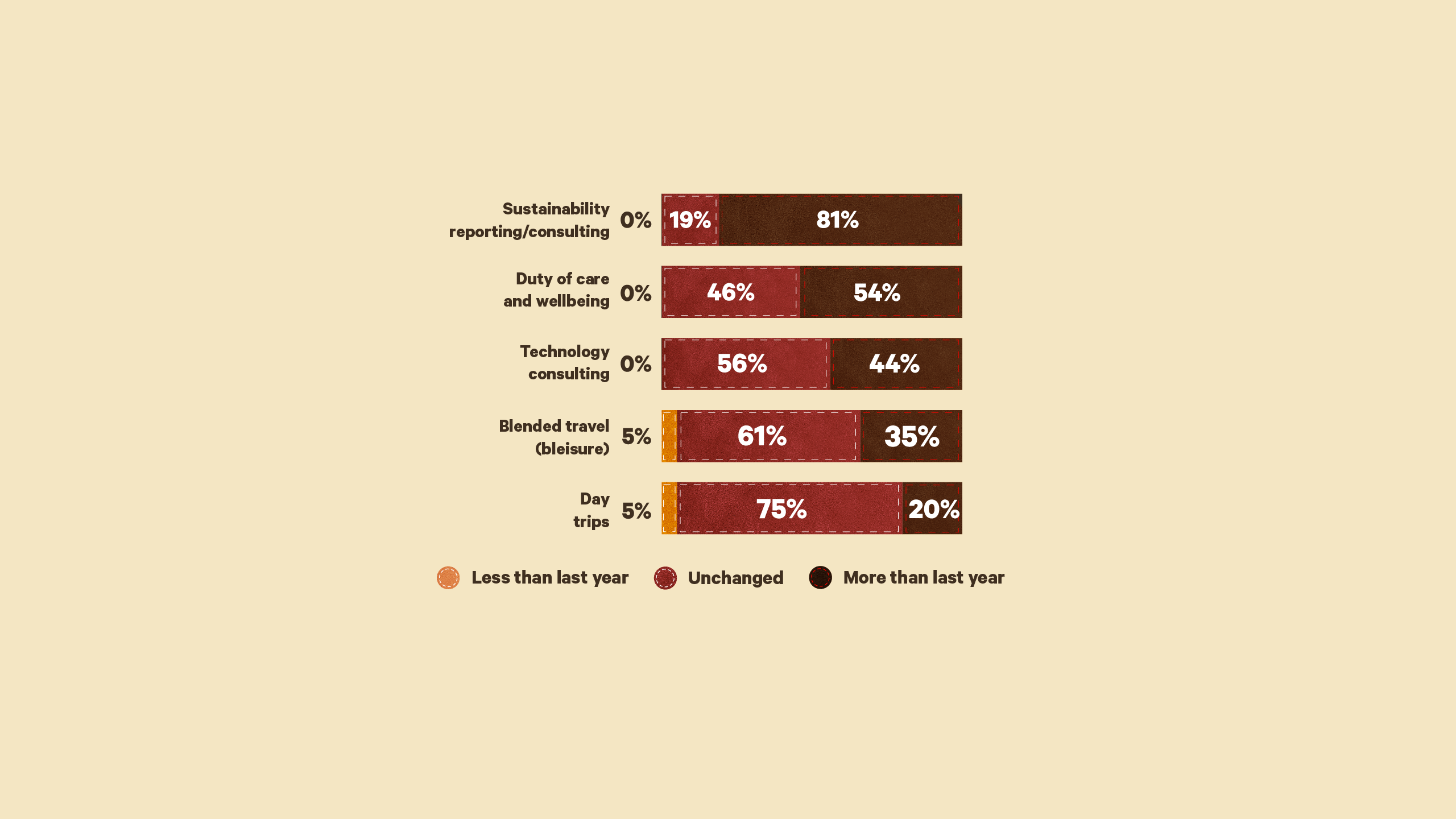

SERVICE ACCELERATION

How has demand for certain TMC services changed?

Of the five services/trends listed, more travel management companies said demand for sustainability reporting and consulting is growing (81 per cent) than any other. More than half (54 per cent) said demand for duty of care and wellbeing support is growing while, conversely, five per cent of respondents reported a decline for both blended travel and very short or day trips.