American Express Global Business Travel will acquire competitor CWT in a transaction worth $540 million 每 a reduced valuation from the original $570 million deal 每 after the US Department of Justice on Tuesday (29 July) dropped its antitrust suit against the mega travel management companies.

Sign up for more...

News ? analysis ? podcasts ? reports

I accept the Terms and Conditions and Privacy Policy.

The DOJ*s lawsuit alleged the combination of Amex GBT and CWT 每 two of the three largest players in business travel management services 每 would create an ※oligopolistic§ environment with too few other travel management players able to scale services to global and multinational companies. This was dismissed on Tuesday, weeks before its scheduled September start.

The long wait

The industry has been in wait-and-see mode since the merger was?announced in March 2024. The UK Competition and Markets Authority was the first to put the brakes on the merger in?June 2024, citing an independent inquiry group that found the deal would lead to less choice and higher prices among large customers, which the CMA defined as having at least $25 million in annual total transaction volume. Amex GBT publicly stated its disagreement with that assessment and pointed to what it called the CMA*s failure to appreciate ※the evidence that reflects the breadth of the business travel industry and its dynamic and competitive nature.§

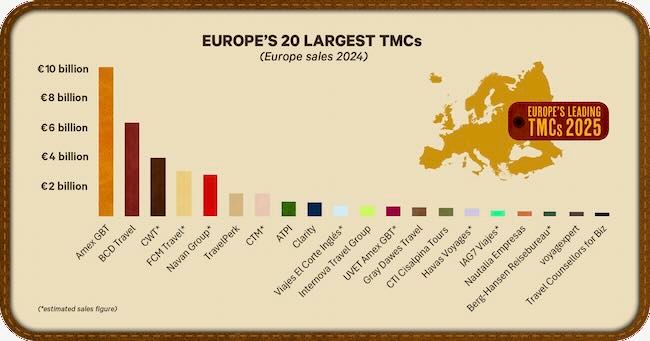

The acquisition will see the merger of Europe's largest and third-largest TMCs

The acquisition will see the merger of Europe's largest and third-largest TMCs

While the CMA continued its investigations, and delayed its decision-making in January 2025, the DOJ, then under the Biden administration, filed its own objections to the merger on 10?January. Amex GBT called the suit ※politically motivated§ and erroneous with ※stale, out-of-context statements that do not reflect today*s competitive landscape.§

The increasing scrutiny caused Amex GBT to push the projected merger?close date to October 2025. It soon became clear, however, the wait could be considerably longer. The DOJ refused a plea from the companies to expedite the suit to a May trial date, even after?the TMCs invoked a ※failing firm§ defense for CWT?in February, reinforcing the case for the merger. The trial date at that point was set for September, pushing Amex GBT and CWT to identify?31 December 2025 as a ※drop dead§?date for the merger. However, an?unexpected U-turn from the CMA?in February signaled a shift in the merger's trajectory and,?in March, the UK watchdog had cleared the deal.

Synergies expected

※We recognise the regulatory approval process has created uncertainty for CWT customers and employees. We*re excited to close the transaction and welcome them to Amex GBT. Together, we will offer customers unrivalled choice, value and experience,§ said Amex GBT CEO Paul Abbott in a statement issued yesterday.

※We are pleased that the DOJ has come to this conclusion,§ said CWT CEO Patrick Andersen in a statement. ※Our customers and people have an exciting future ahead of them as we turn our focus to completing the transaction and integrating with Amex GBT.§

The companies expect the deal to generate approximately $155 million in identified net synergies across operations in more than 140 countries.

The purchase is made up of approximately 50 million shares to be issued at a fixed price of $7.50 per share, with the remaining consideration funded with cash on hand. CWT shareholders will own approximately 10 per cent of the company.

How will buyers respond?

Travel consultants who*ve engaged with the BTN Group in the past 12 weeks have called out the industry*s ※holding pattern§ environment, as the merger of giants remained in regulatory limbo.

Festive Road CEO Caroline Strachan posted on LinkedIn about buyers who have said, ※we*ve extended our contract§ for a year or ※we*re waiting for all this to shake out.§ Nevertheless, she predicted a surge in demand for TMC requests for proposals awaiting the final outcome of the DOJ decision.?

With that now settled, that surge can begin 每 and Strachan foresees no-bids for buyers who have not already built relationships with their target bidders. And she encouraged buyers to consider ※wild-card§ players that ※might be the perfect fit.§

Areka Consulting SVP of North America Charles Bacharach told BTN that his firm already had seen the TMC RFP limbo begin to thaw, especially considering the new TMC options that have become increasingly validated in the months since Amex GBT and CWT originally announced their merger in March 2024.

※What we*ve seen in our business is a lot of the uncertainty on the merger is causing them to go out to RFP,§ Bacharach said on a?BTN Intelligence panel?in May. ※There*s a lot of CWT clients that either are making the decision or have made the decision that they can*t wait for the clarity on how all this is going to end up. And with that, they*re taking matters in their own hands and putting a sourcing activity on the street.§

? See also:?A timeline of the proposed acquisition, as reported by BTN Europe.